Ambulance Cover

All Australian Unity policies provide unlimited emergency ambulance transportation to hospital provided that the transport is coded and invoiced as emergency transport by a recognised State ambulance authority.

Two ambulance attendances per person per calendar year, where you are not taken to hospital.

Benefits are not payable if ambulance service is already covered by a State-based scheme or your ambulance subscription.

Frequently asked questions

What is the after sale process?

All Australian Unity sales require a disclaimer to be read in full. This is found at the bottom of the application page.

A welcome call is made by the fund within 7 days of the application date. If the member does not answer after three attempts a welcome email is sent instead.

After the application process has been completed the member will receive an activation link to guide them to their Online Member Portal.

A welcome pack will be sent within 10 business days of the application date.

Are there loyalty programs or discounts available?

4% discount on Direct Debit with credit card of BSB/ACC. Already included within the pricing, if the member chooses to pay by another method the discount is removed.

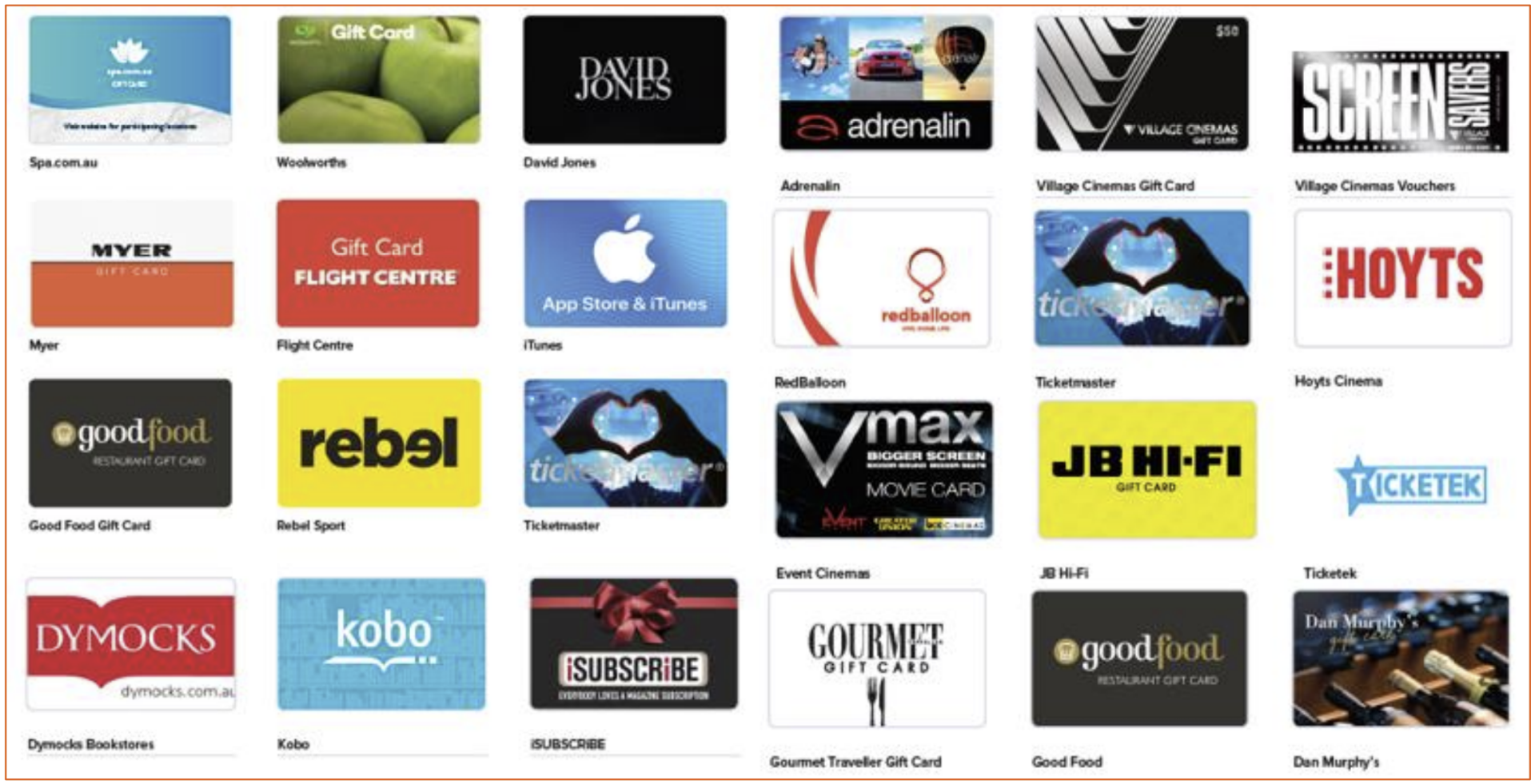

All Australian Unity members will receive Wellplan Rewards which provide various discounts to shopping, movies and dining experiences.

Click here to see Wellplan Rewards.

Unique Selling Points

Getting Healthy (on all products)

- Weight loss - $100 upfront, another $100 when you reach your goal weight. Another $150 if you stay within 5kg of goal weight for 12 months!

- Quit Smoking - $120 per calendar year to complete an approved quit smoking course (Smokenders, Allan Carr Easyway, Quit Foundation)

- Doctor Health Checks – Up to $150 pp pcy towards consultations not covered by Medicare

Staying Healthy (on hospital and combined products)

- Personal Health Coach - $45 toward a health coaching consult (dietician, psychologist)

- Diabetes Australia Membership – 80% of the cost of a Diabetes Aust membership

- Bone Density Scanning – 70% of the cost of a DEXA scan up to $70 pp payable every 5 years if not eligible through Medicare or the free federally funded screening program for Australian aged 70+

Getting Fit (on hospital and combined products)

- Lift for Life - $50 on each stage of the 3-stage program completed

Women’s Health (on hospital and combined products)

- Mammogram Screening – 70% of screening costs not covered by BreastScreen , up to $100

- Cervical Cancer Vaccinations-100% of cost up to $200 payable on three-vaccine treatment

How does Australian Unity define an Accident?

Accident means an unplanned and

unforeseen event, occurring by chance,

and leading to bodily injuries caused

solely and directly by an external force

or object requiring treatment from a

Medical Practitioner (defined here as a

medical doctor who is not the member

or a relative of the Member) within 7

days of the event, but excludes injuries

arising out of: surgical procedures;

unforeseen illness; pregnancy; drug

use; and aggravation of an underlying

condition or injury.

Accident override

If you need hospital treatment for an injury sustained during an Accident that occurred after joining this cover, and the hospital treatment is within a Clinical Category that is listed as Restricted or Not Covered, that hospital treatment will be treated as Covered.

Who are Australian Unity's preferred providers?

When to add a newborn to a policy?

Single Policy at time of birth

To avoid your baby serving waiting periods, it is important that within 30 days of the birth or adoption/ fostering you:

- Upgrade to a Family or Single Parent Family cover; and

- Add your child to the policy. You may also be able to add your Partner to your membership effective your child’s date of birth, or adoption/ fostering date

Single Parent/Couple/Family at the time of birth

It is important that you notify us within 12 months of your child’s birth or adoption/fostering date and add them to your policy effective from their date of birth or adoption/fostering, for waiting periods to be waived.

Please note that Couple memberships will also need to change to a Family membership and back pay any difference in premium (if applicable).

Will you allow a new member to join who was previously on an OVC Cover?

We recognise waiting periods which have been

served with the customer's previous fund, if that fund is an

Australian OVC policy. If a customer switched across without waiting

periods being served, they would not be recognised with us. If the customer

switches to AU OVC from an Overseas OVC, we don’t recognise WPs.

Once granted PR, the member can join a CHIP cover, however we don’t recognise the

waiting periods already served. All waiting periods would be re-served. An OV customer can

take a CHIP policy of it is for MLS purposes, however they cannot claim rebate, and must be

made clear they cannot use the policy for medical purposes, that it is for taxation purposes

only.

In hospital diagnostic services

Any MBS item number is covered up to the scheduled fee, unless otherwise excluded or restricted on the policy. Australian Unity are aware of the issue with Medibank Private and their knowledge was that they don’t have this issue.

Covered treatments means your hospital cover will pay benefits towards:

- Except for the Clinical Category Podiatric Surgery (Provided by a Registered Podiatric Surgeon):

- Medication in hospital approved by the Pharmaceutical Benefits Scheme (PBS) (excluding medication you take home)

- Dressings and other consumables while admitted. Excludes robotic surgery consumables unless otherwise covered for your treatment by the agreement between Australian Unity and the hospital. Please contact your hospital about any out-of-pocket costs

- Most diagnostic tests during your admission e.g. pathology and radiology

- The cost of a prosthesis as listed in the prostheses list set out in the Private Health Insurance (Prostheses) Rules, as in force from time to time.

At home services

Chemotherapy

All of our at-home treatments are managed by the Remedy programs Hospital in the Home, or Hospital Care at Home, which form part of the Health Support Programs. All hospital-only products, and most combined products include access to the Remedy programs, with the exception of Simple Saver, Smart Start and Care N Repair. Eligibility for the programs does depend on patient suitability.All of our at-home treatments are managed by the Remedy programs Hospital in the Home, or Hospital Care at Home, which form part of the Health Support Programs. All hospital-only products, and combined products include access to the Remedy programs. Eligibility for the programs does depend on patient suitability.

Home Birth

Dental fund rules

Preventative Dental

No waiting periods on dental items 011 – 171, (excluding 051, 059, 074, 075, 116, 131, 141 and 142). This means customers can join Australian Unity and book in for a dental check-up straight away! Waiting periods apply to other dental services.

No Gap Dental

No Gap Dental is available on all Extras except and all Combo’s except Simple Saver & Care & Repair

No Gap extends towards:

- Initial Examination

- Scale & Clean

- X-rays

- Topical fluoride treatment

- Preventative examinations

- Custom mouthguard

Service Limits

There are service limits that apply to dental claims, refer to the individual Extras PDF.

Wisdom Teeth Removal

Teeth Whitening

Covered on all level x961-968

Located under Major Dental with Endodontics or Root Canal

Orthodontics (Braces)

Orthodontic benefits are payable on a year by year basis, not upfront, payable on each

year of active treatment.

If a member pays upfront for their orthodontic treatment, each

calendar year of treatment they are required to re-submit their treatment plan so that further

benefits for that calendar year can be made.

Claims are only payable for benefits on services which occur after waiting periods have

been served. In the example, if they commenced treatment prior to joining the fund, or an

eligible table, benefits would be payable on any payments made for treatment after the

waiting period has been served.

AU allow a member to switch mid-treatment, however they require a copy of the initial treatment plan from the Orthodontist, almost as if they were starting a new treatment as such, to be provided by the customer, before the first claim will be paid.

Insulin Pumps and their replacements

Insulin Pump benefits paid by Australian unity

Claiming Insulin Pumps

Omnipod

Cochlear Implants and their replacements

Cochlear devices are not hearing aids, they are listed prostheses on the government

prostheses list.

Hospital and implant benefits are payable by the Fund when the member has an

appropriate level of cover. There is a 12 month waiting period for Pre-existing condition

Benefits for Upgrade/replacement speech processors require pre-approval.

Replacements/Upgrades

AHSA have created a processor Replacement/Upgrade application form which must be

completed by the provider and submitted to the health fund for approval.

Completion of the warranty period is not a valid reason for replacement of a processor.

To be considered for funding a clinical reason for the upgrade or evidence that the device

is no longer functioning, repairable or able to be supported must be provided. The

availability of improved technology is not sufficient reason for an upgrading of a processor.

All requests must be sent to the Clinical Approvals team for consideration.

Note: Upgrades and replacements will not be considered whilst the processor is still under

warranty.

Gym classes or memberships

C-PAP machine rules

An appliance must be supplied by a reputable supplier, who has a registered Australian Business Number (ABN), and authorised by the attending doctor or allied health professional. For a benefit to be paid on some aids and devices, a letter is required (no more than 6 months old) from the treating doctor or health practitioner indicating the medical condition for which the item is required. Please check the Fact Sheets or Ancillary Schedules for more details.

Australian Unity and benefits payable for Artificial Aids and Appliances:

- All Artificial Aids/Appliances have a 12-month waiting period

- Most Artificial Aids and appliances have a 2 year Benefit Replacement Period .

- A letter of recommendation may be required for these purchases.

The following rules apply to letters:

- It should state the condition the aid will alleviate and the referring doctor/health practitioner.

- The letter must be no more than 6 months old at the time of claiming

- A letter is required for the purchase of the first device only. If member requires a replacement device (after the BRP is served, if relevant), no letter will be required.

Orthotics fund rules

Benefit is subject to a 12-month waiting period.

Benefits for orthotics are payable on referral from a recognised podiatrist, chiropractor,

physiotherapist or medical practitioner in private practice. Medical practitioners and

podiatrists do not need to be registered with the specialty code 900.

Orthotics must be an approved external appliance supplied by a recognised provider in

private practice.

Modifications or adjustments do attract a benefit if the purchase of a replacement can be

avoided. Modifications on orthotics are only payable if they are performed more than 3

months after the purchase. If there is a charge raised before this time, it possibly should have

been included as part of the fitting of the original product or payable under the product’s

warranty. We wish to protect our members against over-charging.

A benefit is paid on the actual orthotic only. Any other treatments and/or consultations

relating to the purchase of the orthotics should be paid under the podiatry or relevant

provider’s ‘consultation’ benefit.

Benefits under this modality are primarily for orthotics; when orthotics are not appropriate for

the given medical condition, benefits are payable for custom-made or off-the-shelf shoes

on referral from a recognised Podiatrist or Medical Practitioner in private practice.

Benefits are not payable for a combination of shoes and orthotics; where a charge for both

is raised only the orthotic would attract a benefit.

Benefits are not payable towards the cost of custom made or off the shelf shoes that are

bought to fit orthotics.

Please note: Top Choice covers podiatry but not Orthotics. Ask the customer how they use podiatry, whether it’s just podiatry consults (for feet check ups) or whether they need orthotics. If so, do they buy off-the-shelf orthotics (not covered) or custom-made orthotics. If just podiatry consults, or if they buy off-the-shelf orthotics, then Top Choice is suitable; if they need custom-made orthotics, they need to look at a mix n match extras product

Pharmacy

Benefit is subject to a two-month waiting period.

Claims are processed using the generic provider number 0555555P

No as Ozempic is a PBS item for its intended

purpose

Script numbers and prescribing doctor’s name must be indicated on the account. Each

script must be assessed on a single line, bulking is NOT permitted. However, if there are

multiples of the one pharmaceutical on the one script then the benefit is payable on the

total charge of the script.

Hormone supplements and allergy serums are payable if they have been supplied by a

medical practitioner in private practice. Vitamins, minerals and health supplements do not

attract a benefit

Medical Cannabis

While Commonwealth, state, and territory governments have laws in place to allow the prescribing and dispensing of medicinal cannabis products, as well as cannabis cultivation and manufacture for medicinal purposes, there are currently only two medicinal cannabis medications, Sativex and Epidyolex, that are TGA approved in limited circumstances. These 2 drugs would be payable under a Member’s Extras pharmacy benefits, but only if they meet the fund criteria for payment, advised under section” To claim benefits” above

While TGA can sometimes grant medical practitioners authority to prescribe the specified unapproved medicinal cannabis product for a single patient on a case-by-case basis (through the Authorised Prescriber Scheme or Special Access Scheme-B), the fund does not pay for benefits as these circumstances do not meet the above fund criteria.

Laser eye surgery

Robotic surgery

Australian Unity does not cover this.

The da Vinci Robotic System allows surgery via a keyhole approach which is computer aided

through a dual camera system. Most surgeries that are performed robotically, at this time,

are for Urology, Colorectal, Cardiac and Gynecology treatments.

The cost involves fees for the use of the robotic system, including facility fees charged to the

user (doctor) of the robotic technology together with disposable/consumable items

specifically related to this surgery

- Australian Unity and benefits payable for robotic surgery:

- Australian Unity members are covered for robotic surgery procedures.

- Whether AU pays any benefits towards the cost of the disposables/consumables used for the related procedure, this depends on the terms of the agreement that Australian Unity has with the relevant Agreement Private Hospital. Depending on this Agreement, Australian Unity may pay part or the full cost of the disposables/consumables, or no payment at all. Members must contact their hospital and find out about their out of pocket expenses.

- The facility fee (rental of the robot) is not payable by the Fund. This is a charge for the surgeon to use the robotic technology and an additional out of pocket for the member can be anywhere from $2,500 up to $5,000.

- Assuming the member is covered for the procedure, Australian Unity will also pay the MBS raised by the doctors, theatre fees and bed fees in Private Agreement Hospital. Members will have to pay any excess/ co-payment (if applicable). Check Fact Sheets for coverage

Must know

- Patients can incur significant out-of-pocket costs for robotic consumables as well as the facility fees.

- It is important to advise any members to enquire with their doctor and the hospital about all out-of-pocket expenses and they should request for Informed Financial consent from both hospital and doctors before they agree to have the procedure.

Cosmetic surgery

Australian Unity does not cover cosmetic surgery if it is not medically nessessary.

Gender re-assignment surgery

Gender Reassignment Surgery (GRS) (also referred to as “Sex Reassignment Surgery”) is a

combination of multiple surgeries that changes a person’s physical characteristics to bring

them into alignment with their gender identity, for example, a person that was born female

but identifies as a male.

Patients considering GRS must first undertake psychiatric counselling, which generally

occurs at the same time as the patient commencing Hormone Replacement Therapy

(HRT) with an endocrinologist. Once a psychiatrist and endocrinologist are satisfied that

the patient has met the criteria for GRS, they are given approval to proceed with surgery.

Gender reassignment describes several treatments used to manage the condition Gender

Dysmorphia

Australian Unity and benefits payable for Gender Reassignment Surgery

Private health insurance is not required to pay for gender reassignment surgery as a set

package from beginning to end, as gender reassignment is not a medical diagnosis in

itself.

Although an MBS item number may exist for a certain type of procedure, such as a mastectomy (breast removal or reduction), the item number will only be valid to support a claim for benefits where a medical diagnosis is used, again, which is not the case with GRS related admissions.

Although it is considered as psychiatric condition, benefits are NOT payable under psychiatric hospitalisation because there is no surgical rate for psychiatric admissions. This means that members with Psychiatric benefits are not covered for the procedure. Note: Mental Health Waiver should not be offered as members will not be covered as psychiatric patients for these procedures.

Australian Unity may only pay the medical bed fee for these admissions (i.e. same as nonmedically necessary cosmetic surgeries). Some of our Hospital products pay a medical bed fee for non-medically necessary cosmetic (and other non-MBS) procedures, however, there would still be significant out of pocket costs for the remaining accommodation fees, including excess and other hospital charges, such as theatre fees. In addition, no benefits are payable for the medical fees, such as the surgeon’s or anesthetist’s fees. Check the product Fact Sheets for eligible products.

In-patient Psychiatric Services

Mental Health Waiver

The Mental Health Waiver allows members who have served their two-month Waiting Period for

Restricted Hospital psychiatric services to upgrade to a cover with Included Hospital psychiatric

services and elect to have the two-month Waiting Period for those higher benefits waived.

The waiver only applies to the two-month Waiting Period for the higher Included benefits for Hospital psychiatric services. All other applicable Waiting Periods will continue to apply. Members will only be able to use the Mental Health Waiver once in their lifetime.

Days of Coverage

No information is available at this stage

Suspending a policy

While

your membership is suspended, we

will not pay on any claims for services

or treatments that occur during that

period. Any remaining waiting periods

must be served on reactivation of your

membership.

Overseas Trip

If you’re travelling

overseas, you can suspend your

membership for a minimum of two

months and up to two years. You need

to have at least a hospital cover and

your membership must have been active

for at least one continuous month

prior to your application request and

you must be paid up to or in advance

of the requested suspension date. Your

application must be submitted to us

before your departure. A minimum of

12 months must have elapsed since your

last suspension.

Financial Hardship

If you have been a

Member with hospital cover for at least

12 continuous months and face financial

hardship, you may apply to suspend

your membership. Your membership

must be paid up to the requested

suspension date and the maximum

period you can suspend is three months.

A minimum of 12 months must have

elapsed since your last suspension and

only three periods of financial hardship

suspension will be allowed in a lifetime.

Tax Implications

If you hold hospital cover, suspending your cover may mean you’re subject to the Medicare

Levy Surcharge for the period you’re suspended. This is because you’re not considered by

the Australian Taxation Office (ATO) to hold appropriate private hospital cover for the period.

Contact your Accountant, Financial Advisor or call the ATO on 13 28 61 for more details.

Boarder accomidation

Medical aids and appliances

In determining

whether a device is eligible for payment we consider that it is intended for

repeated use, can alleviate or assist a medical condition and is not useful

where no illness or injury exists.

An appliance must be supplied by a reputable supplier, who has a registered

Australian Business Number (ABN), and authorised by the attending doctor

or allied health professional. For a benefit to be paid on some aids and devices,

a letter is required (no more than 6 months old) from your treating doctor

or health practitioner indicating the medical condition for which the item is

required.

For artificial aids or devices: such as Hearing Aids or Blood Pressure

Monitor, your cover may specify a longer period of time over which the yearly

dollar limit applies for that particular aid or device (noting the yearly limit

still applies for groups of aids/ devices). For example on some covers, the

maximum dollar limit only resets every two calendar years for devices like

blood pressure monitors. During this time you can still claim benefits towards

another blood pressure monitor up to the remaining set limit, which resets

every two calendar years. Where there is a combined limit for a group of

devices or aids, benefits are subject to the remaining limits of the combined

group. Where this applies, your product Fact Sheet says, for example, “Benefit

for each item is payable every 2 calendar years”.

Prosthetic limbs

No information is available at this stage

Clinical Pilates by a Physiotherapist

Australian Unity does not differentiate between physio

modalities – this means we pay a physio session based on the provider’s

registration, not the service.

For example, if the provider is a registered physio

provider, we pay the session as physio, rather than the specifics of the

treatment,ie, physio,vpilates, hydrotherapy etc.so if the provider is a

registered physio, and is using clinical pilates to treat the member, the

session will be paid as physio.